CSP Stands for Impact

CSP - Center for Sustainable Finance and Private Wealth is an academic research and teaching institution at the Department of Finance at the University of Zurich. CSP is unique in its position at the intersection of research and training, bridging scientists, wealth holders, and investment professionals in order to generate knowledge and to mobilize capital toward impact.

CSP Impact Report

Since our inception, our focus has been on responding to the hard questions in sustainable finance and helping individuals and financial professionals maximize their impact.

This year, we are continuing to evaluate the effects of our work by running again our Impact Measurement Project, with the support of external consultants. We encourage you to read through our 2024 Impact Report (PDF, 4 MB) and take a deeper dive into the results of our impact-driven organization.

CSP’s mission is to mobilize private wealth to achieve the targets set by the United Nations Sustainable Development Agenda 2030 and to limit global warming to 1.5 degrees Celsius.

CSP’s vision is that the entire portfolio of every wealth owner fully advances sustainable development, and that the decisions leading to these investments are supported by evidence to maximize positive impact.

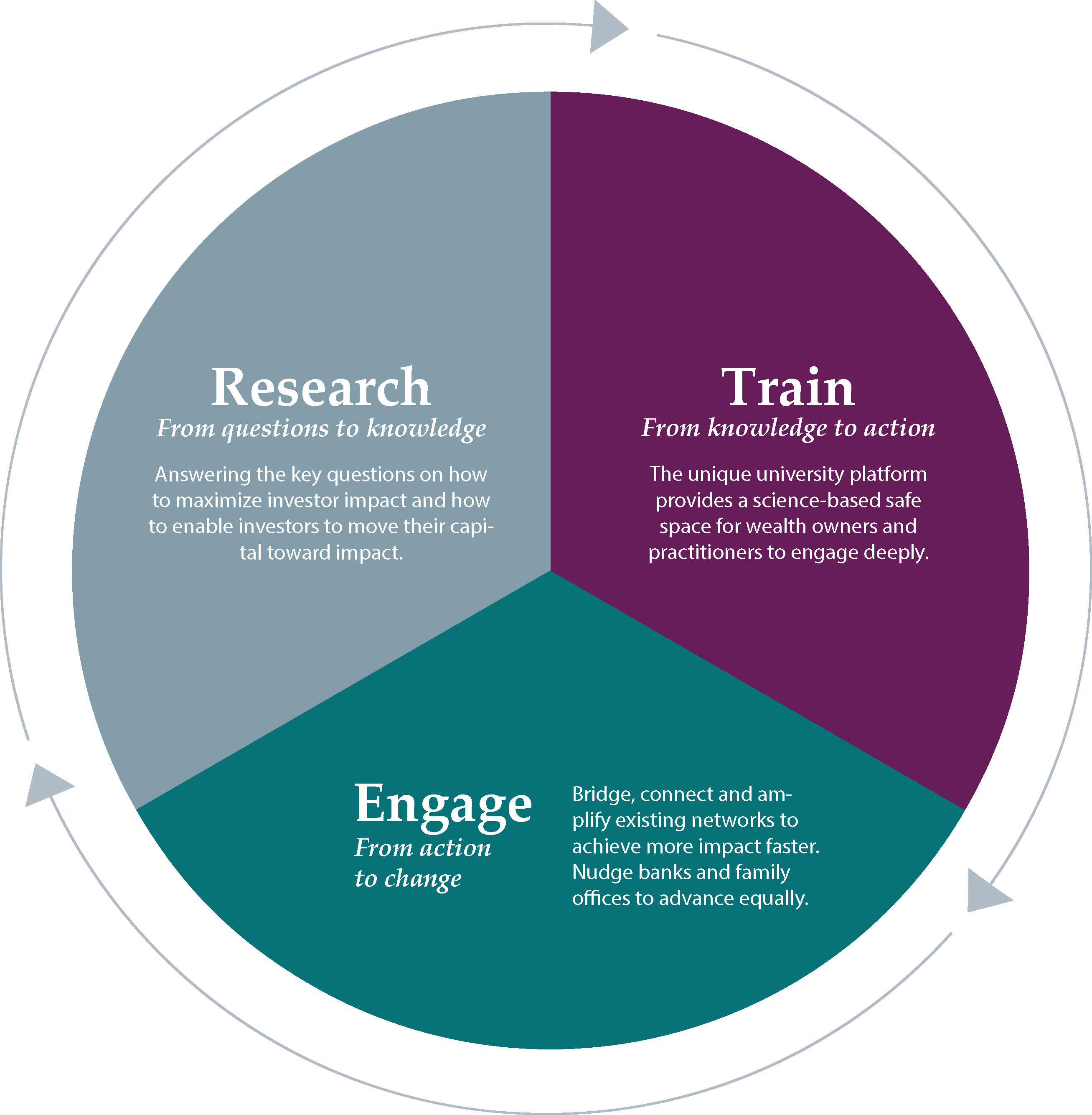

CSP's work can be divided into three streams:

Our research provides answers to how investors can have real impact and what makes investors act for impact. Our trainings enable investors, as key actors in capitalism, to drive positive change. Our partnerships within the landscape support a strong ecosystem that can achieve more faster.

Learn more about how we address barriers and help steer capital towards impact here.

STAY UP TO DATE WITH CSP

Follow CSP on LinkedIn

Want to know what's on at CSP? Find upcoming events, research highlights, job opportunities, and more on the CSP LinkedIn page.

CSP in the Media

As leading voices in impact investing and sustainable finance, the CSP's experts are often cited in international news media. Browse our archive of interviews, videos, and articles here.

Subscribe to Our Newsletter

Get the latest news from CSP delivered to your inbox. For insights into sustainable investing, updates on our training programs, and highlights from our community, sign up for our bi-monthly newsletter.