Insights into Fund Due Diligence for Private Market Funds

What is an investment fund?

Investment funds are collective investments that pool money from different investors. The fund managers buy, hold and sell investments on behalf of the investors. They will look to diversify and spread risk to make a return. Most funds will specialize in one asset class, region or theme, such as private equity, Sub Saharan Africa or biodiversity.

Insights into Fund Due Diligence for Private Market Funds

For investors aiming to achieve real-world impact, particularly by providing capital to help start-ups and early-stage companies grow, due diligence on private equity and venture capital funds is a critical cornerstone. This process is key for making informed and prudent investment decisions, and is a dynamic and intricate journey that can make or break an investment strategy.

This brief guide provides an essential starting point for an investor's due diligence process. These insights stem from our decade of experience at the Center for Sustainable Finance and Private Wealth (CSP), working closely with private wealth holders and their families. Through our educational initiatives and direct engagement, we have helped more than two hundred next-generation wealth holders develop the technical expertise and interpersonal skills to align their investments with their values. This work has consistently demonstrated how private capital can be effectively deployed to create meaningful positive change while meeting financial objectives.

The foundation: Defining an Investment Policy Statement (IPS)

Before embarking on the due diligence journey, it is crucial to establish a solid foundation that clearly defines what the individual investor is looking for. This comes in the form of an Investment Policy Statement (IPS)–an investor's financial compass.

More than just a document, an IPS is a reflection of an investor's financial DNA. It encapsulates:

- An investor's investment goals, short-term and long-term

- Impact objectives (How should their investments change/impact the world?)

- Risk tolerance (How much volatility can an investor stomach?)

- Requirements regarding liquidity (Does the investor plan larger expenditures?)

An IPS is a living document: as an investor's life circumstances change, so should their IPS. It is not set in stone but rather a flexible guideline that evolves with one's financial wants and needs. Learn more about how to craft your Investment Policy Statement in this article.

Identify relevant funds and conduct background research

With an IPS in hand, the investor can start connecting with potential fund managers that align with their stated goals. Seeking advice from one's advisors or network, or joining an investment community like Toniic, The ImPact, CREO, or The Impact Office, can help identify suitable funds and managers. It is crucial to gather additional background information when creating a shortlist.

Kick-start the due diligence process

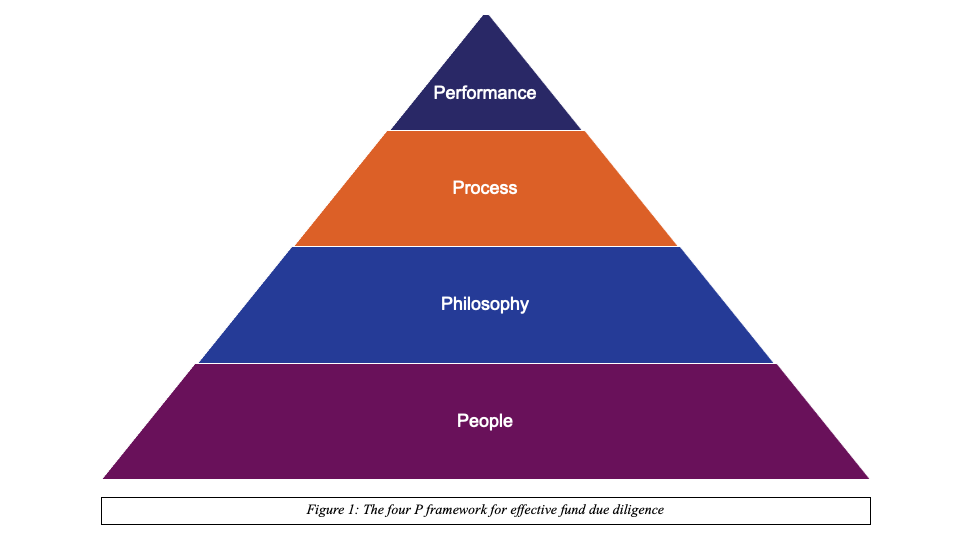

The key premise of conducting a thorough fund due diligence process is to ensure informed investment decisions that prevent misalignments between the investor and the fund managers early on. In private wealth investing, deals are often driven by personal networks and trust, and the due diligence process can appear complex and daunting. However, following clear processes and applying frameworks, like the four P framework above, breaks the process into actionable steps and yields crucial, comparable and replicable results. By initiating direct contact with fund managers in the beginning and scheduling multiple calls or in-person meetings, one can gather the required data, as well as dive deep into the following key aspects:

- Gauge their expertise, passion, and true motivation

- Understand their investment and team philosophy

- Assess cultural fit and alignment with your goals and values

Key Areas for Fund Due Diligence

Fund due diligence is carried out before making a financial commitment that will likely not yield returns for at least seven years, and often for ten years or more. The following overview presents the "four P" critical areas to evaluate when conducting due diligence. While not exhaustive, examining these areas will help address core issues and ensure wealth managers are adequately equipped to invest on an investor's behalf.

Philosophy

Understanding the fund's core philosophy starts with a fundamental question: What market problem is the fund trying to solve with its capital and expertise? This inquiry naturally leads to examining whether the manager operates as a finance-first or impact-first fund and whether their impact objectives align with your own investment goals.

People

When evaluating the team, it is essential to understand its professional expertise and suitability to the investment thesis. Their track record becomes particularly important here—do they have the experience and capacity to execute their strategy effectively? Another critical consideration is whether the team includes members with local expertise in their target markets and portfolio companies. Further—and often the most important aspect, as it can be a leading cause for funds to fall apart—is whether the team has the right culture, processes, spirit, and track record of working together to remain a well-functioning team throughout the fund's investment period. Exploring your network and conducting reference checks can be very insightful.

Process

The fund's operational approach can be assessed by examining its deal sourcing. Are their sources proprietary so that the fund can access unique opportunities? Is their diligence process thorough? How do they help companies increase in value after an investment? A sophisticated fund should have a clear strategy for providing expertise and relationships to help its portfolio companies thrive. Equally important is understanding their plan for providing liquidity to limited partners.

Performance

Past performance tells an important story. What is the managers' track record in similar funds? When examining their history, look for specific examples of value creation and liquidity events that can be directly attributed to the management team. Their track record of creating successful exits for limited partners provides crucial insight into their ability to deliver returns. However, keep an open mind for first-time funds, active in innovative, new, under-served geographies and markets.

Ensuring confidence after reviewing the fund's performance

Due diligence is not just about financial returns but also about understanding how the investment in question can create positive change in the world. By mastering the art of due diligence, you're not just protecting your goals, wealth, and potential for impact—you're shaping the future.

Remember, due diligence is not a one-size-fits-all process. It requires patience, diligence, and a willingness to dig deep. However, the right approach and mindset can be the key to unlocking truly transformative investments that align with both your financial goals and your values.

As you embark on your due diligence journey, keep in mind that it goes beyond avoiding risks—it's about seizing opportunities. With thorough due diligence, you're investing with purpose and becoming an active participant in shaping the future of finance and impact.

Learning

Those looking to master impact investing, fund due diligence, and define an impact policy can do so at the Center for Sustainable Finance and Private Wealth's Impact Investing for the Next Generation course that begins on October 28-31, 2025, with an in-person module at the MIT Sloan School of Management in the United States and concludes on April 28-30, 2026 with an in-person module in Switzerland. The program spans seven months, is flexible enough to allow full-time professionals to participate, and connects members of ultra-high-net-wealth families from around the world to one another.

Those interested in more information, including how to sign up, could write to Marietta Chatzinota at marietta.chatzinota@df.uzh.ch.